Steps to Register an E-Commerce Business in Malaysia

Erra 21 Mar 2025 06:38EN

Malaysia's e-commerce market is rapidly expanding, providing great opportunities for entrepreneurs. However, before launching an online business, proper registration is essential for legal compliance and credibility. Registering your e-commerce business builds trust with customers, grants access to financial services, and opens doors to government support and expansion opportunities.

In this guide, we'll walk you through the key steps to register an e-commerce business in Malaysia, from choosing a business structure and registering with SSM to obtain necessary licenses, setting up a business bank account, and ensuring compliance with local regulations.

Step 1: Register with the Companies Commission of Malaysia (SSM)

In order to establish a legitimate online business in Malaysia, you must first register your company with Suruhanjaya Syarikat Malaysia (SSM). Registration must be completed within one month of starting operations.

For sole proprietorship (Enterprise) businesses in Peninsular Malaysia and the Federal Territory, you can easily register online through the EzBiz portal. But if it's a private limited (Sdn Bhd), limited liability partnership (LLP/PLT), or you're living in East Malaysia (Sabah and Sarawak), then you need to visit the nearest SSM office to register your e-commerce business.

Create an EzBiz Account

If you're an individual business owner, you just need to register your business through the EzBiz portal without needing to visit an SSM office in person. For registration, you must:

-

Be at least 18 years old.

-

Have a MyKad (NRIC) or MyPR (for permanent residents).

-

Provide an active email and phone number.

Once registered, SSM will send a reference number. To verify your account, upload:

-

Scanned copies of both sides of your ID card.

-

A photo of yourself holding the ID at neck level.

-

An official document like your passport or driver's license as proof of address.

Submit Business Registration Form

After you've created the EzBiz account, the next step is to complete and submit online. Meanwhile for those who visited the SSM office, you can get Borang A that is available by the counter. The details that you need to provide are as highlighted below:

-

Main information : Name type (personal or trade), start date, and registration period.

-

Business main address and mailing address

-

Branches information : To register a new branch, you'll need to pay RM5 per year for each branch.

-

Business information : Ensure that the type of business is suitable with your business name. For example if your business name is Gadget Hub, then type of business should be selling electronic devices and accessories.

-

Owner information : For online submission, your information will automatically appear as you already made the verification before filling in the form.

-

Related attachment : If you're B40 entrepreneurs, provide proof you're receiving government funds from MOF/LHDN while for IPT students, attach a copy of the student verification letter.

Pay the Registration Fee

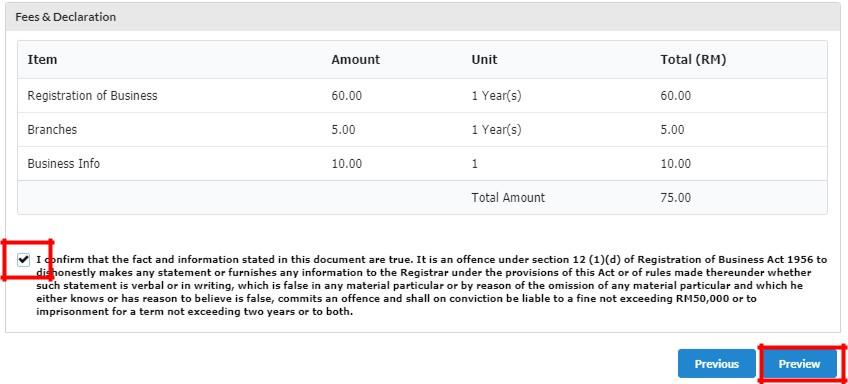

Review all the information provided and if all is completed, you can proceed to pay registration fee:

-

RM30 for a personal name or RM60 for a trading name

-

RM5 for each branch

-

RM10 for business information

When your payment is completed, SSM will notify you via email and SMS. You'll usually receive the Business Registration Certificate within an hour after your application is sent.

Step 2: Apply for Importing and Exporting Documents (if needed)

Apart from a business license, you'll also need certain trade documents if your business involves the process of import and export. Some of the documents needed are:

-

Commercial Invoice : Required for import and export clearances when shipping goods, also acts as foreign currency transactions.

-

Bill of Lading (B/L) : Used for sea shipments where it serves as a contract between the shipper, carrier, and recipient. There are two types of these bills:

-

Negotiable B/L : Can be transferred to someone else, cargo owner will usually hold this.

-

Non-negotiable B/L : Assigned to a specific buyer and can't be transferred. However, changes can be made before the ship arrives by paying extra fees.

-

-

Declaration/Certificate of Origin (CO) : Acted as a proof that the products meet the specific rules of origin before they enter a new country. You'll need this certificate to qualify for benefits like lower import taxes under free trade agreements.

Step 3: Obtain Your Tax Identification

Income Tax

All types of businesses including e-commerce must register for income tax with Lembaga Hasil Dalam Negeri (LHDN). You can register online via MyTax portal or go to the LHDNM office nearby. Apart from your Business Registration Certification (SSM), there are also other documents that you need to prepare that'll be depending on the type of business that you're doing:

-

Individual Online Sellers : Identification cards such as MyKad, Armed Forces, Police ID, or Passport.

-

Local Companies : Notice of company registration or certificate of company incorporation and notice of changes in Directors, Managers And Secretaries.

-

Partnership : Partnership business registration certificate and list of all partners.

-

Limited Liability Partnership : Notice of LLP registration or certificate of LLP OR notice of conversion to LLP and list of partners.

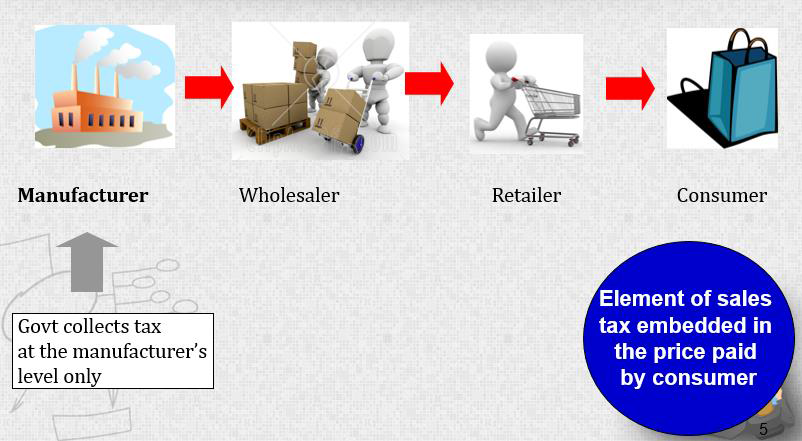

Sales and Service Tax (SST)

SST applies at either the manufacturing/import stage or the point of sale and is divided into two types. The first one is Sales Tax which is applicable if you're selling physical products that are either locally manufactured or imported. Meanwhile, Service Tax is required for companies that provide digital service or sell digital goods like subscriptions, streaming, or digital advertising.

It is mandatory for e-commerce sellers with annual revenue that exceeds RM500,000. Failing to comply will result in penalties, making it crucial for you to understand how this tax applies to your business and follow necessary tax obligations.

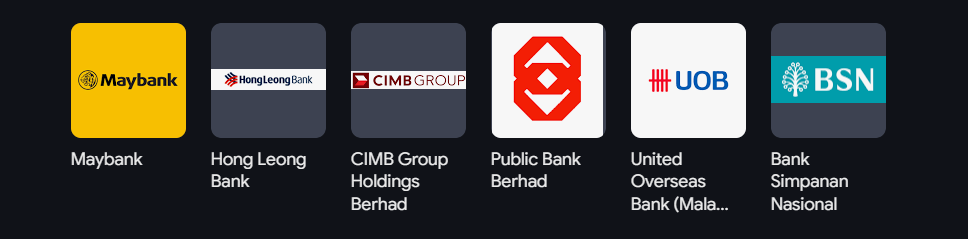

Step 4: Open a Business Bank Account

To keep your personal and business finances separate, you'll also need to open a local business bank account. It helps you with managing transactions, tracking business income and expenses, and making tax reporting easier. To open a business bank account in Malaysia, you typically need:

-

A completed application form from the bank

-

A valid identification card (MyKad or passport)

-

A business registration certificate from SSM

-

Proof of business address (utility bill or tenancy agreement)

-

Minimum initial deposit (varies by bank)

Different banks will require different documentation, so it's best for you to check with your chosen financial institute before applying.

Step 5: Set Up Your E-Commerce Store

Once all the business and tax registration are done, you can now set up your e-commerce store based on your chosen platform.

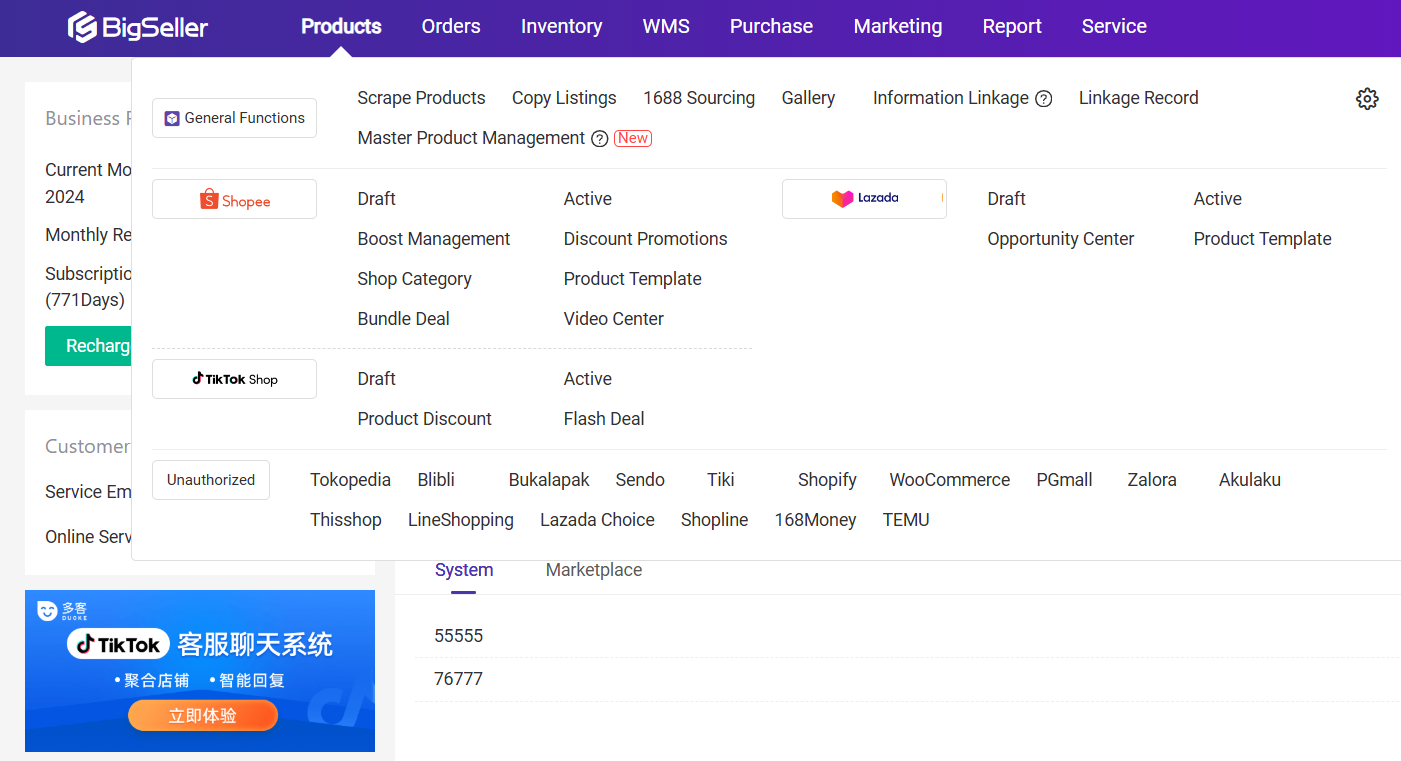

Selling on Marketplaces (Shopee, Lazada, TikTok Shop)

-

Register as a seller and provide your business registration number for verification.

-

Set up your store profile with a logo, banner, and a clear store description.

-

List products with high-quality images, detailed descriptions, and competitive pricing.

-

Optimise listings with relevant keywords to improve search visibility.

Creating Your Own Website (Shopify, WooCommerce)

-

Purchase a (. com.my) domain using your business registration number for credibility.

-

Set up a business email (eg, [email protected]) to build trust.

-

Choose a website builder or hire a web designer.

-

Design a user-friendly site with essential pages: Home, About, Products, and Contact.

Both marketplace and webstore have their own advantages, but if you're still unsure which platform to use, you refer to this guide: https://www.bigseller.com/blog/articleDetails/3022/Marketplace-vs.-Webstore%3A-Which-is-Better-for-Your-Business-in-2025%3F.htm

Manage Your E-Commerce Business Efficiently with BigSeller

Starting an e-commerce business in Malaysia involves several key steps, from business registration and tax compliance to setting up your online store. However, managing daily operations efficiently is just as crucial to success.

BigSeller simplifies e-commerce management by offering tools for inventory tracking, order processing, multi-channel selling, and analytics. By automating key tasks, BigSeller helps sellers save time and focus on growing their business. Whether you're just starting or looking to expand, using the right tools can make a significant difference.

Sign up with BigSeller to streamline your operations and scale your e-commerce business efficiently.

Join BigSeller's WhatsApp Channel for the latest updates, tips, and exclusive insights!