Tax Policies of Shopee 2025

Juliah 27 Jan 2025 02:02EN

Regulations on Creditable Withholding Tax and BIR Registration of Shopee

In 2025, Shopee's tax policies align with the Bureau of Internal Revenue (BIR) Revenue Regulation No. 16-2023, which mandates that electronic marketplace operators, such as Shopee, withhold a 1% income tax on 50% of the gross remittances to sellers or merchants for goods and services sold through their platforms.

Starting January 7, 2025, shopee sellers are required to submit their BIR-stamped "received" Sworn Declaration of Gross Remittances by January 20 of each taxable year to ensure accurate taxation or exemption from the 1% Creditable Withholding Tax.

BIR Revenue Memorandum Circular 08-2024

On April 15, 2024, the BIR published the Revenue Memorandum Circular (RMC) No. 55-2024 announcing the extension of the deadline for compliance to July 14, 2024 .

What is this regulation about?

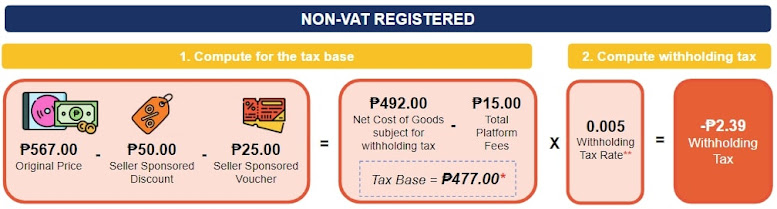

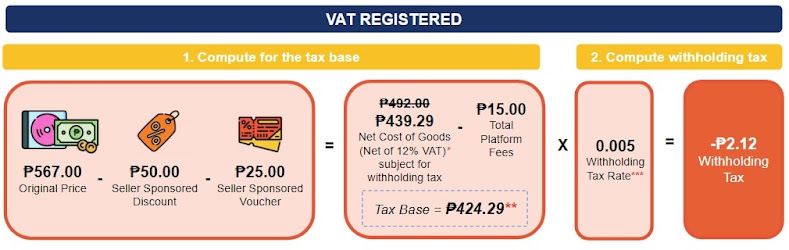

This regulation, based on BIR Revenue Regulation No. 16-2023 , requires local online sellers to be subject to a 1% Creditable Withholding Tax on 50% of their gross income, effectively amounting to 0.5% of their gross sales.

To ensure compliance and determine the applicability of the withholding tax, sellers are required to submit the following documents to Shopee:

-

BIR Certificate of Registration (BIR Form No. 2303)

-

Certificate of Tax Exemption or proof of entitlement to a lower income tax rate, if applicable

-

Sworn Declaration of Gross Remittances, stamped "received" by the BIR, if claiming exemption based on the PHP 500,000 threshold

These measures are put in place to guarantee accurate taxation and adherence to Philippine tax regulations for online transactions carried out on platforms such as Shopee.

Furthermore, all local online sellers are required to register with the Bureau of Internal Revenue (BIR) to engage in online selling.

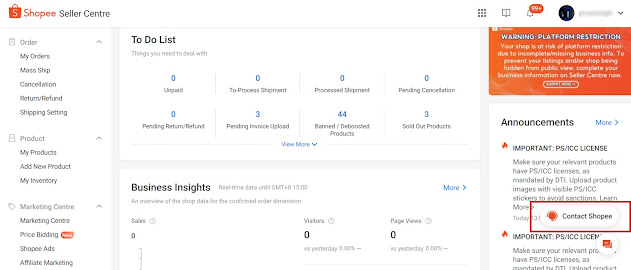

Current sellers must provide their complete Business Information on the Seller Center by July 14 to prevent platform limitations.

What will happen by the deadline?

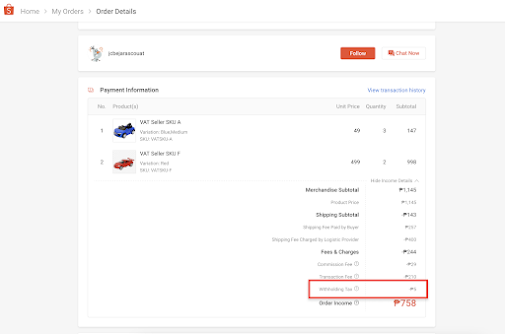

On July 15, 2024, at 12:00 AM, Shopee will automatically apply withholding tax in the following cases:

-

For orders created on or after July 15

-

For all orders escrow verified on or after July 15

If your business information is incomplete, all your orders under escrow starting July 15 will be taxed as Non-VAT. Without a provided TIN, these orders cannot be claimed as a tax credit.

Restrictions: Sellers who fail to complete their business information page may have their product listings hidden from public view or face limited access to their Shopee account.

Does the Withholding Tax Apply to All Sellers?

Under this regulation, the withholding tax applies to sellers or tax entities in the following cases:

-

The seller submits a Sworn Declaration (SD) confirming that their total income exceeds ₱500,000.

-

The seller's total annual gross remittances from Shopee, either from the previous year or the current year, exceed ₱500,000.

-

The seller fails to submit a Sworn Declaration (SD) of gross remittances.

Sellers or tax entities with income at or below this threshold are exempt from the withholding tax, provided they submit a Sworn Declaration stamped and verified by their BIR Revenue District Office (RDO) to Shopee.

Bigseller Help Center

The BigSeller Help Center provides users with essential support through guides, FAQs, and troubleshooting resources. It helps sellers navigate the platform, resolve issues, and optimize their operations. Additionally, it offers updates on new features and direct customer support for a seamless experience.