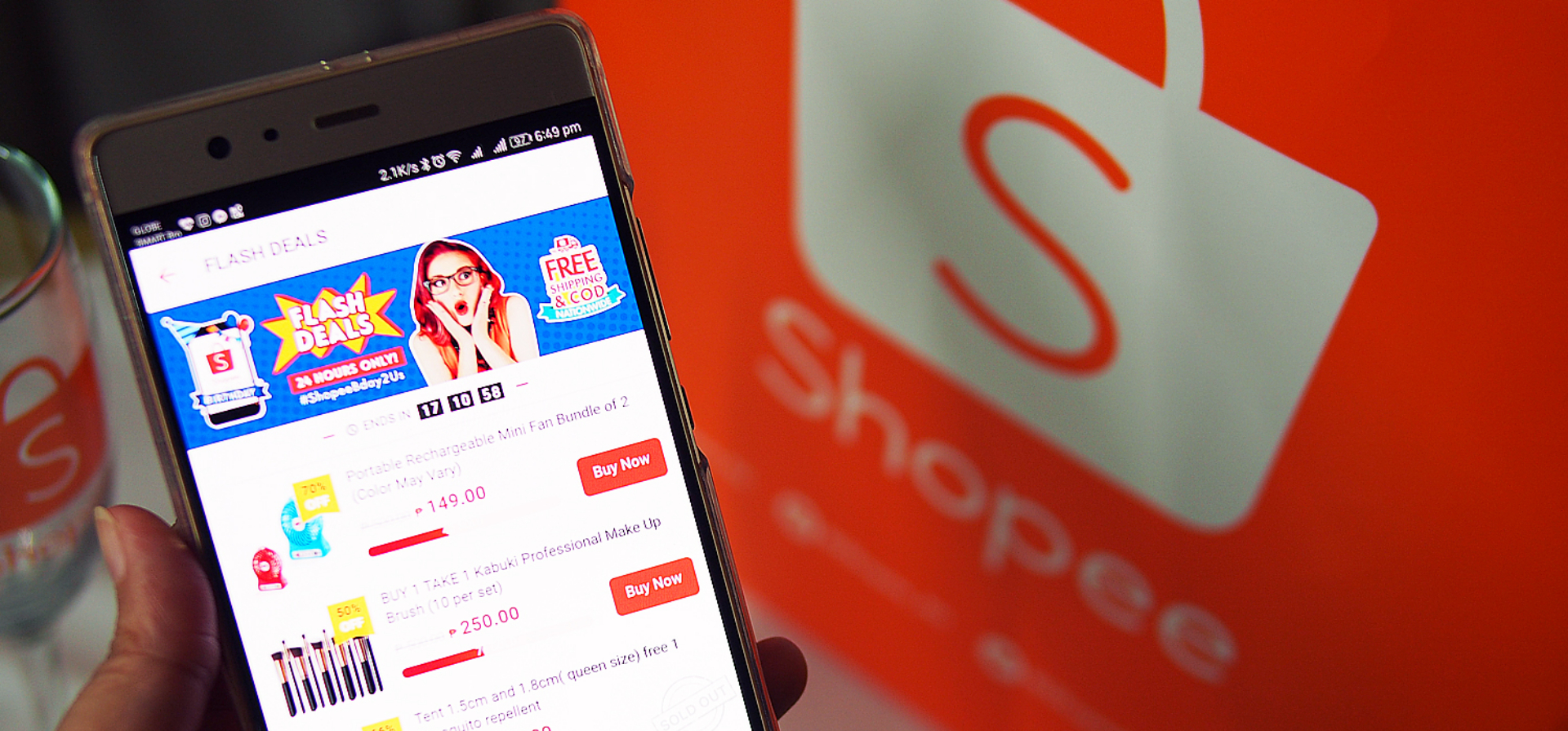

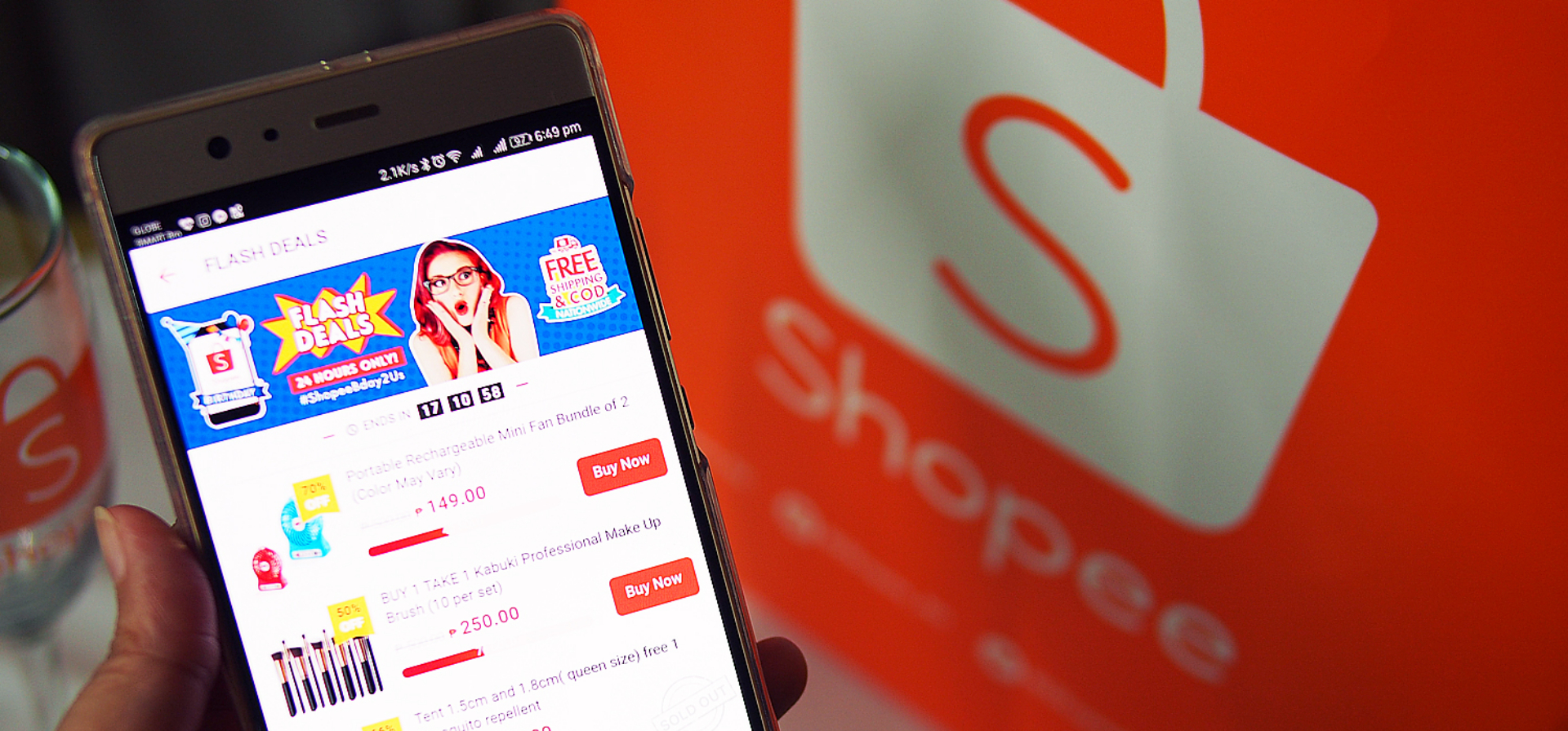

Shopee’s GMV Reached US$78.5 Billion Last Year

Jayson 05 Mar 2024 12:30

On March 5, Shopee parent company Sea announced its fourth quarter and full-year financial reports as of December 31, 2023. The financial report shows that in 2023, Shopee's revenue was US$9 billion, a year-on-year increase of 23.5%; GAAP market revenue was US$7.9 billion, a year-on-year increase of 27.4%; adjusted EBITDA was -213.8 million US dollars; GMV was US$78.5 billion, a year-on-year increase of 27.4%. An increase of 6.8%; the total order volume was 8.2 billion, an increase of 8.8% year-on-year.

As Forrest Li, the founder and CEO of parent company Sea Limited, predicted, the group is on track to achieve its first full-year profit since listing.

Among them, in the fourth quarter of 2023, Shopee's revenue was US$2.6 billion, a year-on-year increase of 23.2%; GAAP market revenue was US$2.3 billion, GMV was US$23.1 billion, a year-on-year increase of 28.6%; the total order volume was 2.5 billion, a year-on-year increase of 46.0 %. After the news was announced, Sea's stock price soared before the market closed. As of March 4, Eastern Time, it was trading at $51.05 per share.

It is reported that in the fourth quarter of 2023, Shopee's GAAP revenue includes core market revenue and value-added service revenue, a year-on-year increase of 23.2%. Due to platform growth and increased commercialization, core market revenue (mainly including transaction-based fees and advertising revenue) increased by 40.6% year-on-year to US$1.6 billion;

Value-added services revenue, which mainly consists of logistics service-related revenue, fell 5.3% year-on-year to US$657.9 million due to an increase in net revenue after deducting freight subsidies.

Forrest Li expects Shopee to maintain market share in the region this year while becoming profitable (in terms of adjusted earnings) in the second half of 2024.

"Despite increased competition in Southeast Asia, we believe Shopee achieved meaningful market share growth between the beginning and the end of 2023. We are pleased to have solidified Shopee's market share in the region, and we intend to continue to maintain our market share in 2024 market, we expect Shopee's full-year GMV growth to be in the high double-digit range and its adjusted EBITDA to turn positive in the second half of this year."

As Forrest Li, the founder and CEO of parent company Sea Limited, predicted, the group is on track to achieve its first full-year profit since listing.

Among them, in the fourth quarter of 2023, Shopee's revenue was US$2.6 billion, a year-on-year increase of 23.2%; GAAP market revenue was US$2.3 billion, GMV was US$23.1 billion, a year-on-year increase of 28.6%; the total order volume was 2.5 billion, a year-on-year increase of 46.0 %. After the news was announced, Sea's stock price soared before the market closed. As of March 4, Eastern Time, it was trading at $51.05 per share.

It is reported that in the fourth quarter of 2023, Shopee's GAAP revenue includes core market revenue and value-added service revenue, a year-on-year increase of 23.2%. Due to platform growth and increased commercialization, core market revenue (mainly including transaction-based fees and advertising revenue) increased by 40.6% year-on-year to US$1.6 billion;

Value-added services revenue, which mainly consists of logistics service-related revenue, fell 5.3% year-on-year to US$657.9 million due to an increase in net revenue after deducting freight subsidies.

Forrest Li expects Shopee to maintain market share in the region this year while becoming profitable (in terms of adjusted earnings) in the second half of 2024.

"Despite increased competition in Southeast Asia, we believe Shopee achieved meaningful market share growth between the beginning and the end of 2023. We are pleased to have solidified Shopee's market share in the region, and we intend to continue to maintain our market share in 2024 market, we expect Shopee's full-year GMV growth to be in the high double-digit range and its adjusted EBITDA to turn positive in the second half of this year."